SoFi Stock Price Prediction 2050

SoFi Technologies, Inc. (NYSE: SOFI) has established itself as a significant player in the financial technology (fintech) industry. With its focus on providing a range of financial services such as student and personal loans, mortgages, investment products, and more, SoFi continues to capture attention in the stock market. The company’s growth, backed by solid fundamentals, has raised curiosity among investors, especially those looking for long-term investments.

In this article, we will delve into SoFi stock price predictions for 2050 and examine the factors that could influence its future trajectory. We will explore SoFi’s current financial status, past performance, growth prospects, and future market trends that may shape its stock price in the coming decades.

Table of Contents

SoFi Technologies Inc. Profile Overview

Company Overview

- Stock Name: SoFi Technologies, Inc.

- Stock Symbol: SOFI

- Stock Exchange: NYSE

- Market Cap: $8.517 Billion USD

- P/E Ratio: 30.73

- Headquarters: San Francisco, California

- Established: 2011

- Founders: Mike Cagney, Dan Macklin, James Finnigan, Lan Brady

SoFi Technologies has rapidly grown since its inception in 2011, carving a niche in the fintech sector by offering an array of financial services tailored to the modern consumer. The company’s mission is to help people achieve financial independence through products designed to meet their diverse needs.

Ownership Structure

- Insider Holdings: 3.25%

- Institutional Holdings: 42.27%

- Floating Institutional Holdings (FHI): 43.79%

- Number of Institutions Holding Shares: 722

SoFi has a significant portion of its stock held by institutions, which speaks to investor confidence in the company’s long-term growth. Institutional holdings provide stability to the stock, and the company’s insider ownership signals that its leadership is committed to driving success.

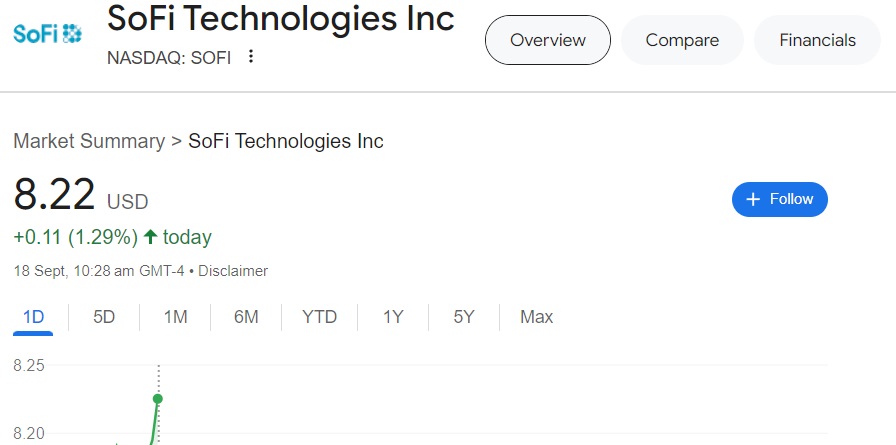

Current Financial Overview and Market Performance

SoFi’s financials paint a picture of a fintech company positioned for continued growth. With a market cap of $8.517 billion USD and a P/E ratio of 30.73, the company’s valuation reflects optimism for future expansion, despite high levels of debt that come with being a fast-growing fintech firm.

SoFi Stock Price Prediction for 2024-2025

As we look ahead, SoFi’s stock price predictions for 2024 and 2025 reflect a pattern of volatility, a hallmark of high-growth companies in emerging sectors.

SoFi Stock Price Prediction for 2024

SoFi’s stock price is expected to fluctuate within a wide range throughout 2024, reflecting both market uncertainty and growth opportunities. According to market analysts, here are the projected price ranges for each month in 2024:

| Month | Target Price (USD) |

|---|---|

| January | $9.75 to $7.72 |

| February | $7.47 to $9.13 |

| March | $6.05 to $9.45 |

| April | $7.93 to $6.64 |

| May | $6.64 to $7.72 |

| June | $7.43 to $6.22 |

| July | $6.22 to $8.13 |

| August | $6.06 to $8.30 |

| September | $8.10 to $7.20 |

| October | $7.51 to $8.50 |

| November | $8.20 to $9.30 |

| December | $9.10 to $9.70 |

The projected stock price volatility reflects potential reactions to macroeconomic conditions, regulatory changes in the fintech sector, and SoFi’s own business performance.

SoFi Stock Price Prediction for 2025

Looking into 2025, SoFi is predicted to gain momentum, primarily due to improvements in its core operations and increased demand for its fintech solutions. Based on technical analysis and market sentiment, the stock is expected to continue its growth trajectory.

| Month | Target Price (USD) |

|---|---|

| January | $10.30 to $8.63 |

| February | $7.54 to $9.23 |

| March | $8.05 to $9.45 |

| April | $9.93 to $10.61 |

| May | $11.64 to $12.70 |

| June | $9.49 to $8.27 |

| July | $7.21 to $8.10 |

| August | $10.06 to $11.30 |

| September | $8.10 to $9.28 |

| October | $11.51 to $12.59 |

| November | $11.29 to $13.63 |

| December | $12.23 to $14.78 |

SoFi Stock Price Prediction for 2026-2027

By 2026, SoFi’s stock price is expected to break out of its consolidation phase, potentially driven by improvements in profitability, technological advancements, and strategic partnerships.

2026 Price Projections:

| Month | Target Price (USD) |

|---|---|

| January | $15.50 to $16.68 |

| February | $17.51 to $18.29 |

| March | $19.10 to $17.49 |

| April | $18.97 to $19.68 |

| May | $20.73 to $21.75 |

| June | $19.37 to $18.31 |

| July | $20.22 to $23.19 |

| August | $21.39 to $22.35 |

| September | $23.18 to $21.49 |

| October | $22.83 to $24.93 |

| November | $23.10 to $24.87 |

| December | $21.23 to $23.85 |

2027 Price Projections:

By 2027, analysts predict SoFi’s stock price will continue its upward trajectory as the company leverages new technologies and expands its offerings:

| Month | Target Price (USD) |

|---|---|

| January | $20.22 to $21.79 |

| February | $22.32 to $24.12 |

| March | $25.19 to $26.70 |

| April | $27.91 to $28.89 |

| May | $26.71 to $29.81 |

| June | $28.12 to $30.10 |

| July | $31.29 to $32.20 |

| August | $33.40 to $34.39 |

| September | $34.22 to $35.51 |

| October | $36.91 to $38.92 |

| November | $35.10 to $34.11 |

| December | $34.29 to $31.36 |

Long-Term SoFi Stock Price Predictions: 2030-2050

Looking ahead to 2030, SoFi’s stock is projected to benefit from increased adoption of its platform as well as broader market trends in digital finance and blockchain-based services. The company’s ability to innovate and adapt will be crucial in determining its stock price trajectory.

SoFi Stock Price Prediction for 2030

| Month | Target Price (USD) |

|---|---|

| January | $49 to $51 |

| February | $50 to $53 |

| March | $52 to $55 |

| April | $53 to $56 |

| May | $52 to $55 |

| June | $50 to $53 |

| July | $52 to $56 |

| August | $50 to $53 |

| September | $54 to $59 |

| October | $58 to $60 |

| November | $59 to $63 |

| December | $61 to $65 |

SoFi Stock Price Prediction for 2050

As we move toward 2050, predicting stock prices becomes increasingly speculative due to market uncertainties, technological advancements, regulatory environments, and macroeconomic factors. However, based on current growth trends, SoFi could become a dominant player in the financial sector. If the company continues to expand its services and capitalize on its competitive advantages, it could achieve significant long-term growth.

| Year | Price Target (USD) |

|---|---|

| 2031 | $60 to $70 |

| 2035 | $90 to $100 |

| 2040 | $120 to $145 |

| 2045 | $130 to $160 |

| 2050 | $140 to $175 |

Factors Influencing SoFi’s Long-Term Stock Price

Several key factors will likely shape SoFi’s stock price in the long term:

- Technological Innovation: SoFi’s ability to stay ahead of fintech trends, such as blockchain, AI-driven financial services, and personalized banking, will play a critical role in its stock price performance.

- Regulatory Environment: Fintech is subject to shifting regulations, and any significant changes in financial laws could impact SoFi’s operations and growth prospects.

- Expansion into New Markets: If SoFi can successfully expand its offerings to international markets, its revenue potential could increase dramatically, driving up the stock price.

- Consumer Adoption: The continued adoption of SoFi’s platform by millennials and Gen Z, who are more likely to prefer digital-first financial services, will fuel long-term growth.

- Macroeconomic Trends: Factors like inflation, interest rates, and economic stability will also have a bearing on the stock’s performance.

Conclusion

SoFi Technologies Inc. is poised for substantial growth over the coming decades, driven by its innovative approach to fintech. While the stock may experience volatility in the short term, its long-term outlook remains promising. By 2050, the company’s stock could potentially reach $140 to $175 if it continues to expand, innovate, and capitalize on emerging market trends.

Investors interested in SoFi should consider the company’s solid fundamentals, its place in the growing fintech sector, and its ability to adapt to technological and regulatory changes.

Also read – Russell 2000 Index FintechZoom: An In-Depth Analysis