Grab Stock Price Prediction

Grab Holdings Limited, a leading Southeast Asian tech company, has emerged as a major player in the ride-hailing, food delivery, and digital financial services markets. Its initial public offering (IPO) through a SPAC merger in 2021 created a lot of buzz in the market. Since then, Grab’s stock price has experienced significant fluctuations, driven by a variety of market factors. In this article, we will provide a comprehensive analysis of Grab’s stock price prediction, covering its current performance, key factors influencing its stock, and what experts are forecasting for its future.

Table of Contents

Overview of Grab Holdings Limited

Grab was founded in 2012 as a ride-hailing service but has since expanded its services to include food delivery, digital payments, and other on-demand services. The company’s mission is to improve the quality of life in Southeast Asia by providing convenient services to consumers and creating economic opportunities for its partners.

Grab operates in eight countries across Southeast Asia, including Singapore, Malaysia, Thailand, Indonesia, and the Philippines. The company went public in December 2021 through a merger with a special purpose acquisition company (SPAC), Altimeter Growth Corp., making it one of the largest Southeast Asian companies listed on the NASDAQ.

Grab’s IPO and Initial Market Performance

Grab’s IPO was a much-anticipated event in the tech industry. The company’s listing on NASDAQ valued it at nearly $40 billion. However, after the initial excitement, Grab’s stock price has faced volatility. The stock opened at around $13.06 per share and has since seen significant declines and fluctuations due to various market factors, including the broader sell-off in tech stocks.

Grab’s stock price is influenced by several factors, which we will explore in detail below.

Key Factors Influencing Grab’s Stock Price

1. Market Competition in Southeast Asia

The Southeast Asian market is highly competitive, especially in the digital economy sectors like ride-hailing and food delivery. Grab faces stiff competition from regional players like Gojek in Indonesia, Foodpanda, and international giants such as Uber. The company’s ability to maintain and grow its market share in this competitive landscape is a key factor influencing its stock price.

2. Macroeconomic Conditions

Macroeconomic factors such as inflation, interest rates, and consumer spending trends also play a significant role in shaping the stock price of companies like Grab. For example, rising interest rates can increase borrowing costs, affecting growth projections and profitability. Similarly, inflation can erode consumers’ disposable income, which in turn affects spending on non-essential services like ride-hailing and food delivery.

3. Expansion of Digital Financial Services

One of Grab’s most significant growth opportunities lies in its expansion into digital financial services through its GrabPay and Grab Financial Group. The company has ambitions to become a major player in the digital banking space, particularly after securing a digital banking license in Singapore. If Grab can execute this strategy effectively, it could become a major revenue stream for the company and positively impact its stock price.

4. Operational Performance

Grab’s quarterly earnings reports are closely watched by investors as a reflection of its operational performance. Key metrics such as gross merchandise value (GMV), revenue growth, and net profitability are important indicators of the company’s financial health. Strong quarterly results can boost investor confidence, while underperformance may lead to a drop in stock price.

5. Technological Innovations

Grab’s ability to adopt new technologies and improve its service offerings can also influence its stock price. Innovations in autonomous driving, artificial intelligence, and blockchain technology could provide new growth avenues for the company and increase investor confidence in its long-term potential.

6. Regulatory Environment

Grab operates in a region with varying regulatory environments, which can affect its ability to operate and expand. Changes in ride-hailing regulations, financial regulations, or data privacy laws in key markets like Indonesia or Thailand could have significant implications for the company’s business and its stock price.

Grab Stock Price History and Performance

Since going public, Grab’s stock price has experienced ups and downs due to market volatility and company-specific challenges. As of 2024, Grab’s stock is trading below its initial IPO price, raising questions about the company’s future prospects. Let’s take a look at Grab’s stock price performance in key periods:

1. Post-IPO Decline

Following its IPO, Grab’s stock price saw a sharp decline, driven by market sell-offs in the broader tech sector and concerns about the company’s profitability. The stock fell from its IPO price of around $13 per share to as low as $2 per share in 2022.

2. Pandemic Impact

The COVID-19 pandemic played a significant role in influencing Grab’s stock price. While demand for food delivery services surged during lockdowns, the ride-hailing segment faced reduced demand as people stayed at home. This created a mixed financial outlook for Grab during the pandemic.

3. Recent Recovery

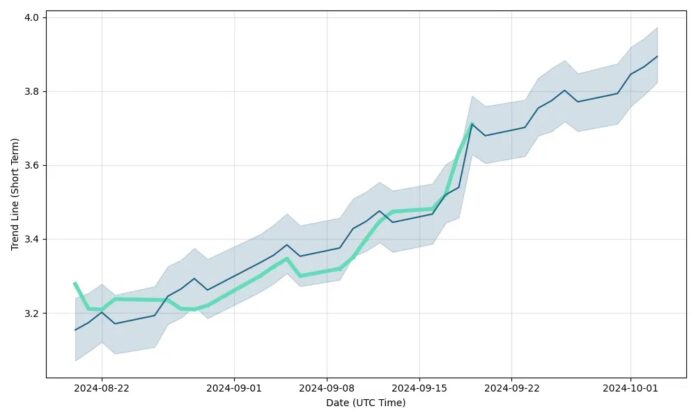

In 2023 and early 2024, Grab’s stock price has shown signs of recovery as the company reported improvements in its financial performance and continued expansion in its digital financial services. By mid-2024, Grab’s stock price was hovering around the $4-$5 range.

Grab Stock Price Prediction for 2024 and Beyond

1. Short-Term Outlook (2024)

In the short term, analysts expect Grab’s stock price to experience moderate growth. Several factors are contributing to this outlook, including improved profitability in its food delivery and digital payments segments. Analysts predict that the stock could reach around $6-$8 per share by the end of 2024, depending on the company’s execution of its growth strategies and overall market conditions.

2. Mid-Term Forecast (2025-2027)

By 2025, Grab’s digital banking services are expected to be fully operational in key markets like Singapore and Malaysia. This could serve as a major revenue driver for the company. Additionally, autonomous vehicle development and partnerships with local governments could give Grab a competitive edge in the transportation sector. If these initiatives are successful, Grab’s stock price could potentially rise to $10-$12 per share by 2027.

3. Long-Term Potential (2028 and Beyond)

In the long run, Grab’s success will depend on its ability to dominate the Southeast Asian market and expand into other regions. If Grab becomes a leading player in the digital financial services space, as well as maintains its leadership in ride-hailing and food delivery, analysts predict that Grab’s stock price could soar to over $15 per share by 2028.

Expert Opinions on Grab Stock Price Prediction

Several financial analysts and investment firms have shared their opinions on Grab’s stock price prediction. While some remain cautiously optimistic, others see potential for significant long-term growth.

1. Goldman Sachs

Goldman Sachs analysts have a neutral rating on Grab’s stock, noting that while the company has significant growth potential, the intense competition in the Southeast Asian market and regulatory risks pose challenges to sustained stock price growth. They predict that Grab’s stock price could reach $8 per share by 2025, depending on its ability to expand its digital banking services.

2. Morgan Stanley

Morgan Stanley is more bullish on Grab’s stock price. They believe that Grab’s strong market position in ride-hailing and food delivery, combined with its foray into digital banking, makes it a high-potential stock for long-term investors. Their target price for Grab by 2027 is $12 per share.

3. JP Morgan

JP Morgan analysts have a cautious outlook on Grab, citing concerns about the company’s profitability and the broader economic environment. They believe that Grab’s stock price will face volatility in the short term but expect it to recover to around $7 per share by 2025.

Risks and Challenges for Grab

While Grab’s stock price prediction shows potential for growth, it is essential to consider the risks and challenges the company faces.

1. Profitability Concerns

Like many tech companies, Grab has struggled with profitability. Although the company has shown improvements in its financial performance, sustained profitability remains a concern. Any delays in achieving profitability could negatively impact its stock price.

2. Regulatory Risks

As mentioned earlier, Grab operates in a region with varying regulatory environments. Changes in transportation or financial regulations in any of its major markets could affect the company’s operations and stock price.

3. Economic Conditions

Global and regional economic conditions, including recessions, inflation, and currency fluctuations, could impact consumer demand for Grab’s services, which would, in turn, affect its stock price.

Conclusion

Grab’s stock price prediction offers both opportunities and risks for investors. The company’s dominant position in Southeast Asia’s digital economy, combined with its expansion into digital financial services, makes it a compelling long-term investment. However, challenges such as market competition, regulatory risks, and profitability concerns must be considered.

Investors should monitor Grab’s quarterly performance and key developments in its expansion strategies to better understand the trajectory of its stock price in the future. In the short term, Grab’s stock is expected to show moderate growth, but the long-term potential remains promising for those willing to navigate the inherent risks of the tech sector.

Also read about – SoFi Stock Price Prediction 2050: A Comprehensive Analysis